A cashless society is becoming more and more realistic as digital takes over

The digital era is well and truly in fashion; almost everything appears to be geared towards technology as it becomes more accessible than ever before. Financial transactions are no longer limited to the cheque book and cash as digital payments have taken over the world of money.

The online world is one that is likely to never stop growing. Online promotions such as Which Bookie free bets have become increasingly popular and cashless countries are no longer a pipedream as society becomes obsessed with technology and the pace of it. But, just how has the digital world taken over finance?

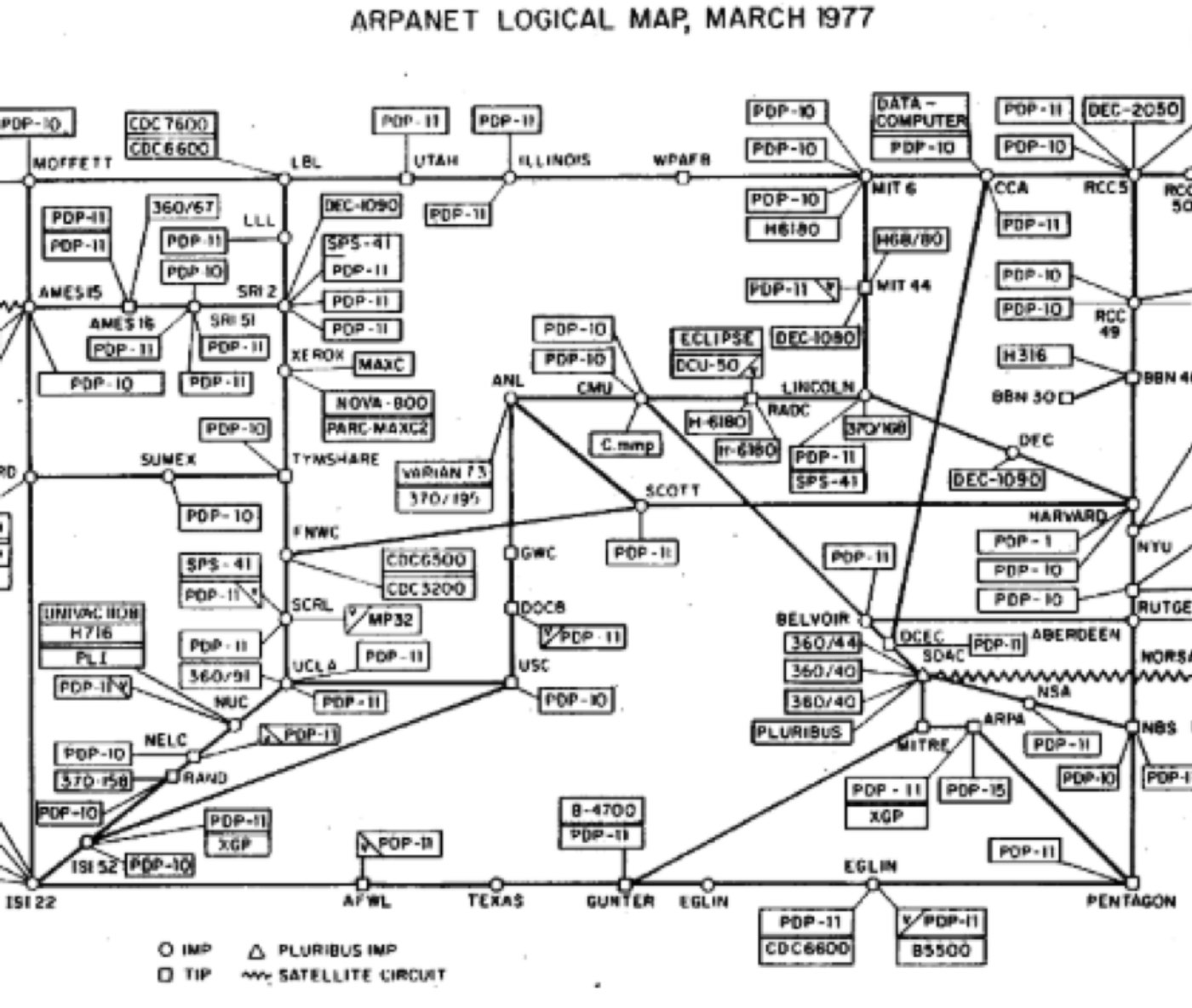

ARPANET, internet and the WWW

An internet connection is, naturally, essential for digital payments to take place. It was the development of ARPANET (Advanced Research Projects Agency Network) in 1969 that set the internet on its way with the first use of the TCP/IP protocol suite. This, in layman’s terms, provided the foundation of the modern internet.

ARPANET may have set the ball rolling, but it was Sir Tim-Berners Lee’s World Wide Web that took the internet into new and exciting heights in 1989. The merging of hyperlinks with web pages and sites enabled the realisation of digital payments.

Online payments with eservices

The creation of the World Wide Web proved the catalyst for online payment services to grow. The Stanford Federal Credit Union led the way in 1994, offering online internet banking services for the first time. However, particular knowledge of data transfer protocol was needed, making the service troublesome and difficult.

The proliferation of epayment services in the mid-1990s - Millicent, ECash and CyberCoin for example - offered ecash, digital tokens or tokens as cash alternatives with ecommerce giant Amazon founded in 1994.

Paypal and Apple Pay

Paypal seems to have been around since the internet began, but in fact it’s just two decades old. It came into being in 1999, but became popular as ebay users tried to find an easy payment service. It’s now a leader in epayment with the addition of different currencies and methods to reduce fraud key reasons for its boom.

Paypal was rewarded with an EU banking in license in 2007 given its huge growth, but Paypal is being left behind. Launched in September 2014, Apple Pay has allowed an iPhone fingerprint scanner to pay for goods whilst Amazon and Google have improved wallet functionality and the ease with which to gamble online.

Cryptocurrency: the future

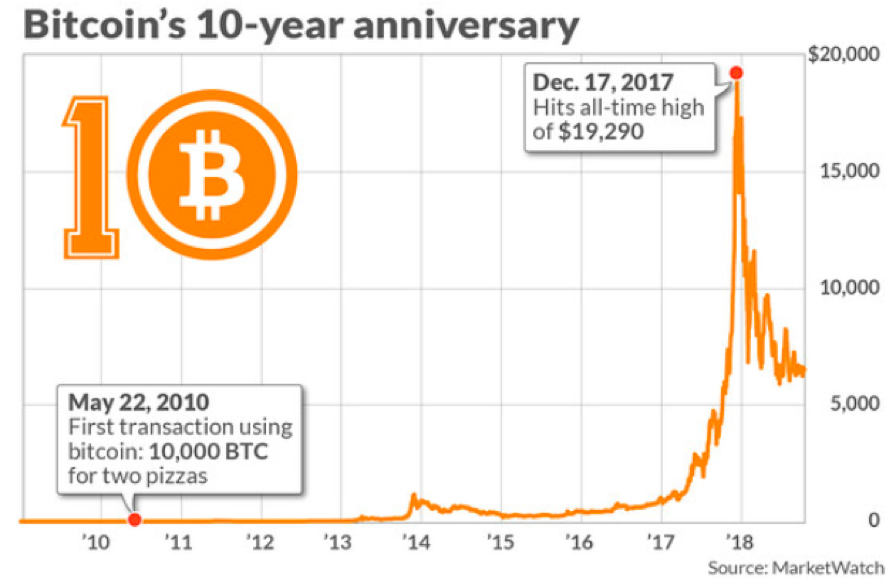

Bitcoin’s creation in 2009 saw digital payment develop into another world. Bitcoin became the first digital currency to succeed in doubling spending - as a decentralized currency - without needing a reputable authority or central server. A truly different direction, Bitcoin could well prove to be the onset of a new future of digital payment.

A cashless society is more than realistic given the rapid evolution from the introduction of ARPANET to the expansion of cryptocurrency. The latter appears to be where the future of digital payments lies as cheques and cash fall increasingly out of fashion. And, they could be lost forever in the near future as the pace and ease of digital payments renders them useless.